Your Customer Research is a Joke. Here's How to Fix It.

Discover essential customer research questions that can give you a competitive edge. Learn how to ask the right questions and boost your insights today!

Posted by

Related reading

Stop Asking Useless Survey Questions. Steal These Instead.

Stop guessing. Get battle-tested survey questions examples to find out what your customers actually want. Real talk, no fluff. Just actionable insights.

Your "Perfect Customer" Is a Myth, and It's Costing You Money

Stop guessing. This guide to customer segmentation analysis provides battle-tested tactics for founders to identify and target their most profitable customers.

Fix Your Customer Feedback Questionnaire Now

Revamp your customer feedback questionnaire with brutally honest advice. Get actionable insights and stop wasting your customers' time with bad surveys.

Let’s be honest. Most 'customer research' is garbage. You run a survey, get some vanilla feedback, and build a feature nobody uses. Why? Because you're asking polite questions and getting polite, useless answers. You’re treating it like a tea party, not an interrogation for the truth.

I've burned more cash on features born from 'customer feedback' than I care to admit. The problem isn't listening; it's how you listen and what you ask. You have to stop asking what customers want and start digging for what they need—the ugly, inconvenient truths they don't even know they have. If you’re not making them slightly uncomfortable, you’re not digging deep enough.

This isn’t another generic list of survey prompts. These are the specific customer research questions that get you to the real pain, the actual buying triggers, and the hidden objections that kill deals. They are designed to cut through the fluff and expose the underlying problems your business should be solving.

These are the questions that separate the founders who build monuments from those who build tombstones. Pay attention.

1. 'Describe the last time you dealt with [The Problem]. Walk me through it, click by click.' (Instead of: What are your pain points?)

"Pain points" is a sterile, corporate buzzword that gets you sterile, corporate answers. It invites your customer to intellectualize their problem, giving you a polished summary of their frustration. You don't want a summary; you want the raw, unfiltered footage of their struggle. Asking someone to recount a specific, recent experience forces them to relive it.

This is the difference between asking "How's your commute?" and "Tell me about the traffic jam this morning." The first gets you "It's fine, I guess." The second gets you the story about the guy who cut them off, the podcast they missed, and the spilled coffee. The real innovation lies in the details of the spilled coffee. This is a core technique in any real guide to Voice of Customer analysis.

The Takeaway: Stop asking for summaries and start demanding stories.

2. 'How do you currently solve this problem?' (Instead of: Who are your competitors?)

Asking about "competitors" is lazy. You’ll get a list of the usual suspects and miss the real picture. Your biggest competitor isn't another company; it’s a clunky spreadsheet, a series of panicked emails, or just plain old inertia. You need to uncover the Frankenstein's monster of a system your customer has duct-taped together to survive.

The messier their current solution, the bigger your opportunity. People are surprisingly loyal to their own broken systems until you show them a dramatically better way.

The Takeaway: Your real competitor is their current, ugly workaround—map it, then kill it.

3. 'What would an ideal solution look like to you?' (Instead of: What features do you want?)

Asking customers for feature requests is a fool's errand. It turns them into armchair product managers, leading to a bloated, incoherent roadmap based on whims, not needs. This question sidesteps the "faster horse" problem by asking them to paint a picture of their destination, not design the car.

People don't want a quarter-inch drill bit; they want a quarter-inch hole. This question forces them to describe the perfect hole, giving you the freedom to invent the laser that gets them there.

The Takeaway: Hunt for the desired outcome, not the requested feature.

4. 'What factors are most important when making this purchase decision?' (Instead of: What's your budget?)

Asking about budget is a race to the bottom. This question forces a trade-off. It uncovers the internal scoreboard they use to judge you, your product, and everyone else. It shifts the focus from price to a hierarchy of needs.

Is it security? Ease of use? Speed? You're not just asking for a list; you’re asking for the internal logic that dictates whether a deal closes or a customer chooses a competitor. This is how you stop competing on price and start competing on value. This is a foundational concept in crafting effective market research questions, which you can explore further in our deep dive on market research.

The Takeaway: Find their non-negotiable decision criteria and build your pitch around it.

5. 'Who else is involved in the decision-making process?' (Instead of: Are you the decision-maker?)

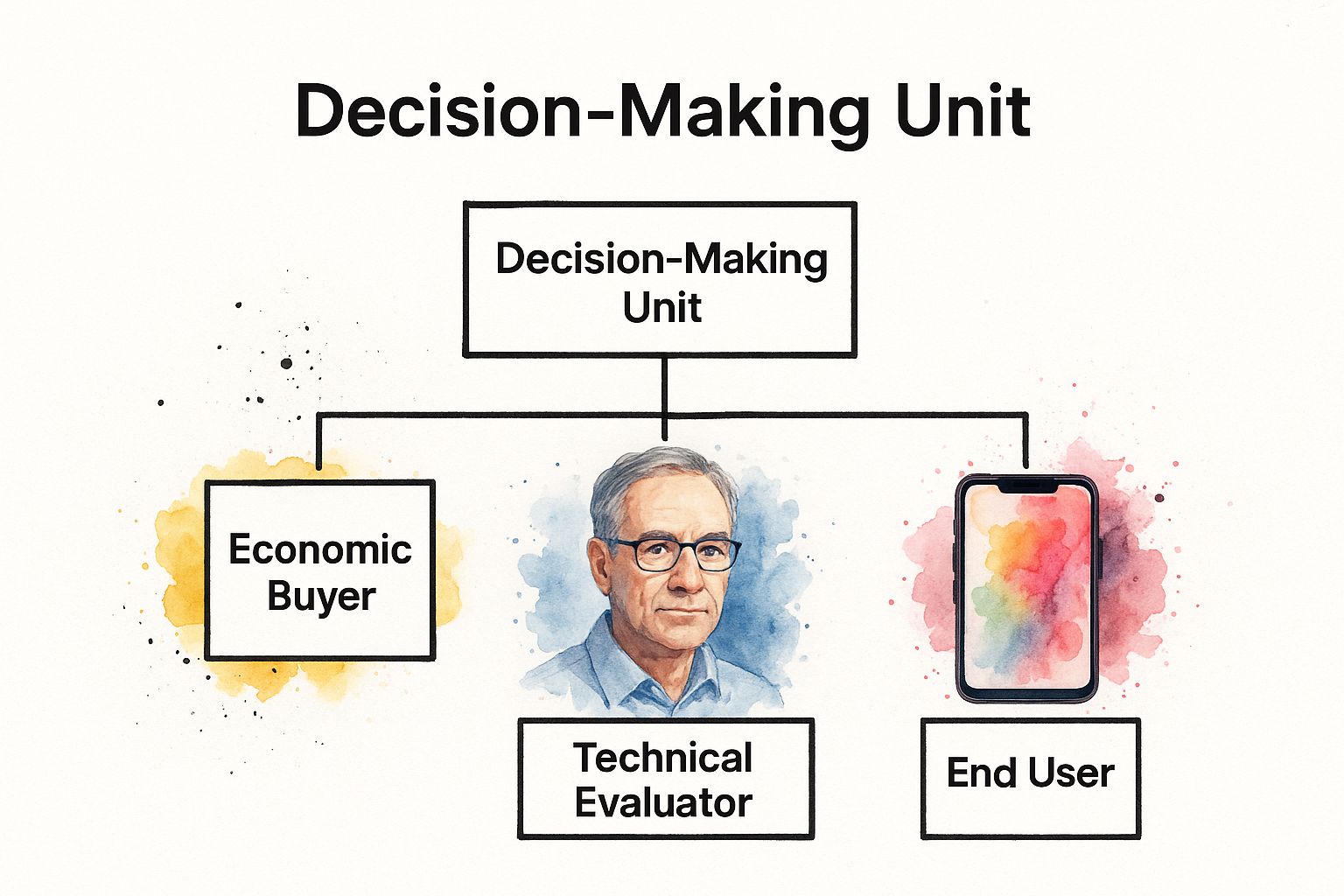

Thinking your user is your only buyer is a rookie mistake that gets B2B deals killed in committee. You get a single person to love your product, only to find out they have zero budget authority. The deal dies, and you have no idea why. You sold to the enthusiast, not the economic buyer or the IT admin who has to approve the security review.

Ignoring the committee is like pitching a movie to an actor without getting the director on board. It’s a dead end.

The Takeaway: Map the entire political landscape of the purchase, or get ambushed by a silent veto.

6. 'What concerns or objections do you have about our solution?' (Instead of: What do you like about it?)

Asking what customers like is a vanity metric. It feels good and does absolutely nothing to stop the quiet churn that’s bleeding you dry. You need to actively hunt for the "buts" and "what ifs" that are killing your deals. This question flips the script from seeking validation to seeking the truth.

The sale isn't made by ignoring objections; it’s made by uncovering and demolishing them. These customer research questions are designed to dig up the landmines before you step on them.

The Takeaway: Hunt for objections with the same energy you hunt for praise.

7. 'What has been your experience with similar products?' (Instead of: What don't you like about Competitor X?)

Asking about "competitors" gets you a list of brand names. You don't want a list; you want their entire relationship history, complete with the messy breakups. This question exhumes the ghosts of products past, revealing the scars and baggage they bring to your doorstep.

Their history is your crystal ball. Every frustrating onboarding and every failed implementation is a lesson someone else paid millions to learn. Steal the curriculum. This is a key part of any good guide on getting customer feedback.

The Takeaway: Your competitor’s churn is your best product research.

Stop Admiring the Problem and Do Something

There you have it. Questions that get you more truth in an hour than a year of NPS surveys. But knowing what to ask is useless if you don't have the guts to do it. The real work starts when you stop theorizing and start talking to actual human beings who might give you money.

This isn't about collecting feel-good quotes. It's about systematically de-risking your business. It's about finding the landmines before they blow up your runway.

Once you start asking, you're going to get a firehose of raw, messy feedback. This is where most founders drop the ball. They let that goldmine of data rot in a forgotten Google Doc. They admire the problem, get overwhelmed, and then go back to building what they wanted to build anyway.

Don't be most founders. You need a system to turn those scattered interview notes into undeniable patterns. Stop guessing. The answers to what you should build, how you should market it, and what you should charge are sitting in the heads of your customers, waiting for you.

Stop letting customer insights die in a spreadsheet; use Backsy.ai to automatically find the gold in your interview transcripts.